Should I Wait or Buy a House Now?

In 2025, deciding whether to buy a home now or wait is one of the toughest financial choices many individuals and families face. With interest rates hovering around the high 6% range and economic uncertainty clouding the horizon, it's easy to see why many potential buyers feel stuck between a rock and a hard place.

In 2025, deciding whether to buy a home now or wait is one of the toughest financial choices many individuals and families face. With interest rates hovering around the high 6% range and economic uncertainty clouding the horizon, it's easy to see why many potential buyers feel stuck between a rock and a hard place.

However, there are solid reasons to consider jumping into the market now—and just as many valid arguments for waiting. Let’s break down the pros and cons, assess where the market might be headed, and help you determine the best path for your situation.

Pros of Buying a Home Now

1. Rent Prices Are Still Rising

If you’re currently renting, you're probably no stranger to annual increases. Nationally, rent prices have been steadily climbing for the past several years and are projected to continue rising in 2025, albeit at a slower pace than in previous inflationary periods.

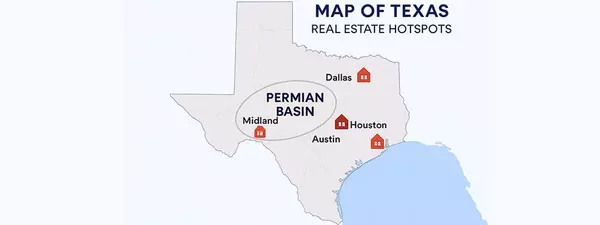

Midland residents can anticipate a 17.7% year-over-year rise in median rent — the sixth highest among all small U.S. metropolitan areas. According to the latest report, renters in the Midland metropolitan area can expect a significant 17.7% year-over-year increase in rent prices — the sixth largest jump among all small U.S. metros. The median rent in Midland was $1,679 in 2024 and is projected to rise by $298, reaching $1,977 in 2025.

Bottom line: Buying now may protect you from unpredictable rental hikes and allow for long-term savings.

2. Start Building Equity Sooner

Homeownership is a long game. The earlier you get in, the sooner you start building equity—the portion of your home you actually own. Unlike rent payments that disappear into a landlord’s pocket, mortgage payments steadily reduce your loan balance and increase your equity.

Even if home prices grow at a modest rate over the next few years, owning a property allows you to benefit from that appreciation. Over a 5 to 10-year period, that growth has the potential to substantially boost your net worth.

Bonus: That equity can be tapped later through refinancing or a home equity loan if needed.

3. Less Competition in Slower Months

The real estate market has its own seasons, and historically, the late fall and winter months see fewer buyers. Lower competition in the market can result in more favorable conditions for buyers - including better price negotiations, potential closing cost concessions, and additional time to make informed decisions.

In fact, data from Redfin shows that homes listed in December and January tend to sell for slightly less and stay on the market longer, giving buyers leverage.

Takeaway: Buying during an off-peak season may improve your odds of getting a better deal - even in a high-rate environment.

Cons of Buying Now

1. Rent Prices Are Still Rising

If you’re currently renting, you're probably no stranger to annual increases. Nationally, rent prices have been steadily climbing for the past several years and are projected to continue rising in 2025, albeit at a slower pace than in previous inflationary periods.

Midland residents can anticipate a 17.7% year-over-year rise in median rent — the sixth highest among all small U.S. metropolitan areas. According to the latest report, renters in the Midland metropolitan area can expect a significant 17.7% year-over-year increase in rent prices — the sixth largest jump among all small U.S. metros. The median rent in Midland was $1,679 in 2024 and is projected to rise by $298, reaching $1,977 in 2025.

Bottom line: Buying now may protect you from unpredictable rental hikes and allow for long-term savings.

2. Start Building Equity Sooner

Homeownership is a long game. The earlier you get in, the sooner you start building equity—the portion of your home you actually own. Unlike rent payments that disappear into a landlord’s pocket, mortgage payments steadily reduce your loan balance and increase your equity.

Even if home prices grow at a modest rate over the next few years, owning a property allows you to benefit from that appreciation. Over a 5 to 10-year period, that growth has the potential to substantially boost your net worth.

Bonus: That equity can be tapped later through refinancing or a home equity loan if needed.

3. Less Competition in Slower Months

The real estate market has its own seasons, and historically, the late fall and winter months see fewer buyers. Lower competition in the market can result in more favorable conditions for buyers - including better price negotiations, potential closing cost concessions, and additional time to make informed decisions.

In fact, data from Redfin shows that homes listed in December and January tend to sell for slightly less and stay on the market longer, giving buyers leverage.

Takeaway: Buying during an off-peak season may improve your odds of getting a better deal - even in a high-rate environment.

Cons of Buying Now

1. Interest Rates Are High ( high 6% range )

The elephant in the room: mortgage rates. As of mid-2025, average 30-year fixed rates remain around the high 6% range, a significant jump from the historic lows of 2020 - 2021, when rates dipped below 3%.

This higher rate results in greater monthly payments and more interest paid over the course of the loan.

$400,000 mortgage at 3%, for instance, would have principal and interest payments of about $1,686 each month. At 6.8%, those same payments jump to about $2,086—a difference of nearly $400 per month.

From a financial planning perspective, this can limit your homebuying budget or squeeze your cash flow in other areas.

2. Inflation Is Pressuring Household Budgets

While inflation has cooled slightly from its peak, everyday expenses—from groceries to gas—are still elevated. This can make it harder to save for a down payment, build an emergency fund, or comfortably afford a mortgage.

For buyers stretching their finances to afford a home, this could result in added stress and potential long-term strain.

Important note: Make sure you factor in all homeownership costs - insurance, taxes, maintenance - when evaluating affordability.

Future Outlook: What Might Happen if You Wait?

So, what if you decide to wait? Could things improve in your favor?

Rates May Drop in the Next 12 - 18 Months

Many experts predict that mortgage rates could decline if inflation continues to ease and the Federal Reserve shifts its policy stance. If that happens, you could potentially refinance to a lower rate after purchasing now, reducing your long-term interest costs.

We've seen it before - Purchasing a home when interest rates are high and refinancing later when they decrease can potentially result in beneficial financial outcome. If your financial foundation is solid, buying now doesn't mean you're stuck at the high 6% rate forever.

Just be sure to calculate the cost of refinancing (usually a few thousand dollars) and confirm that you’ll stay in the home long enough for it to pay off.

Prices Could Rise Again

After a relatively flat year, home prices in many markets are starting to edge upward again. Much of this is tied to a housing supply shortage, along with long-term demand trends driven by Millennials entering their peak homebuying years.

There’s also the oil market factor: energy prices have a ripple effect on material and construction costs. As oil prices stabilize or rise, builders may pass those costs onto buyers, nudging home prices higher.

Waiting could save you on interest - but if home prices jump 5 - 10%, you might break even. Timing the market perfectly is nearly impossible.

Final Thoughts: Should You Buy Now or Wait?

There’s no one-size-fits-all answer. The right decision depends on your financial readiness, personal goals, and tolerance for risk.

You Might Consider Buying Now If:

You’re financially stable with a steady income and solid credit.

Rent is eating a significant portion of your budget.

You intend to stay in the house for at least 5–7 years.

You’re comfortable refinancing later if rates fall.

You Might Wait If:

Your budget is tight and a high-rate mortgage would overextend you.

You’re unsure about your job, location, or long-term goals.

You’re still building savings for a down payment or emergency fund.

In short: Don't buy out of fear of missing out (FOMO), but don’t wait blindly, either. Educate yourself, crunch the numbers, and talk to a trusted lender or real estate agent about your local market.

Next Steps

Run the numbers. Use a mortgage calculator to estimate payments at different rates. ( https://www.bankrate.com/mortgages/mortgage-calculator/ )

Speak to a lender. Get prequalified and understand your buying power.

Speak to a Realtor®. I’d be happy to help answer any questions you may have ( https://yvonnerosas.exprealty.com )

Research your market. Some cities are still cooling, while others are heating up again.

Consider a rate buydown. Some lenders offer options to lower your rate for the first 1–3 years.

Whatever you decide, make sure it fits your financial picture and your future. Buying a home is not just a transaction - it’s a foundation for your life.

Need help deciding if now is the right time to buy?

Let’s talk strategy.

Yvonne Rosas, REALTOR®, 2x Icon Agent, GRI, ABR®, NCREA

432-202-0069

Odessa – Midland, Texas

Categories

Recent Posts

REALTOR®- ICON AGENT | License ID: 716775

+1(432) 202-0069 | yvonne.rosas@exprealty.com